Dutch Bangla Bank Limited DBBL Job Circular 2023 – www.dutchbanglabank.com. Dutch-Bangla Bank Limited recently issued a recruitment circular for the position of Junior Channel Officer (JCO). Candidates from all districts of the country can apply for the post.

Contents

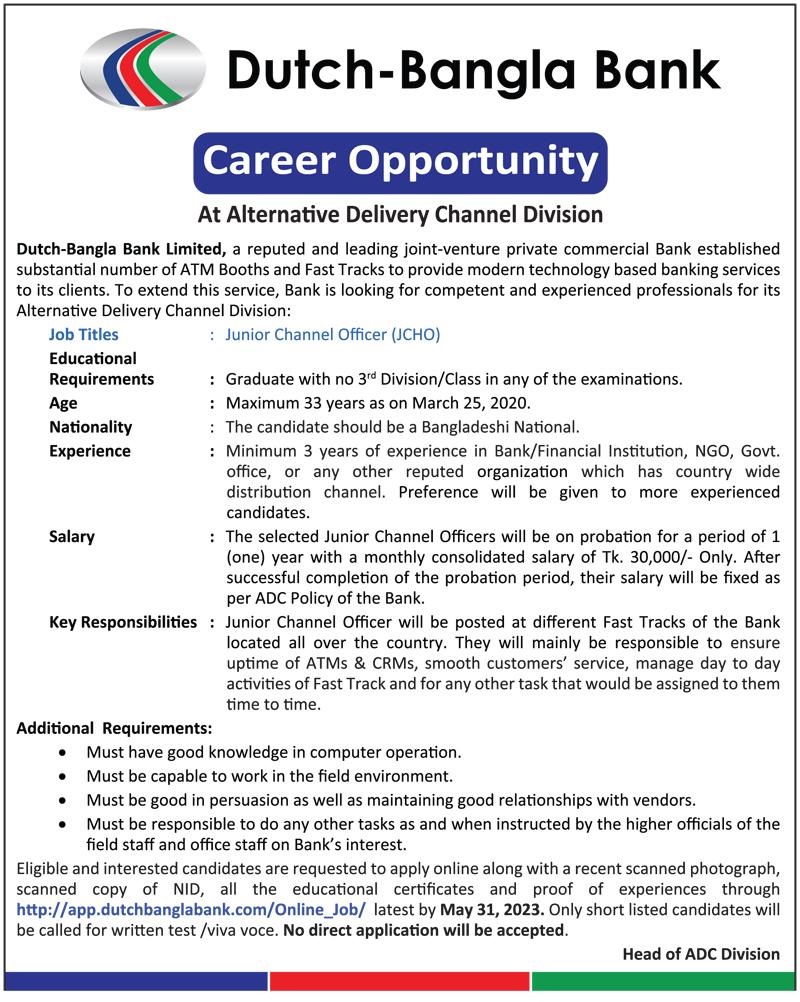

DBBL Job Circular 2023

2023 is a golden opportunity to build a banking career. Because since the beginning of the year, more banking recruitment circulars have been published or are being published. Candidates can apply according to their eligibility in the bank of their choice.

Job Summary

- Bank Name: Dutch Bangla Bank Limited.

- Title of Position: Junior Channel Officer.

- Number of Vacancies: Not yet declared.

- Employment Status: Full Time.

- Circular Date: 20 May 2023.

- Application Closing Date: 31st May 2023.

- Apply Mode: Online.

- Official Website: www.dutchbanglabank.com.

Dutch-Bangla Bank Limited Job Circular 2023

Private Dutch-Bangla Bank Limited has released a notification for the recruitment of manpower. The bank will hire junior channel officers. Now we discuss the details of Junior Channel Officers of Dutch Bangla Bank Limited.

- Position Title: Junior Channel Officer.

- Number of Vacancies: Not yet mentioned.

- Educational Qualification: Minimum Graduation with no 3rd division or class in academic results.

- Age: Not over 33 years old as on 25 March 2020.

- Experience: Must have a minimum of 03 years of experience in the Banking Sector or Financial Institute.

- Salary: Probation period salary is 30000 Taka. But after successfully completing the probation period, the salary will be paid as per company policy.

Job Responsibilities of Junior Channel Officer For DBBL

Junior Channel Officer will be posted at different Fast Tracks of the Bank located all over the country. They will mainly be responsible to ensure the uptime of ATMs & CRMs, smooth customer service, manage day to day activities of Fast Track, and for any other task that would be assigned to them from time to time.

Additional Requirements of DBBL Job 2023

- Be a Bangladeshi National.

- Good knowledge of computer operation.

- Capable to work in the field environment.

- Good in persuasion as well as maintaining good relationships.

- Responsible to do any other tasks as and when instructed by the higher officials of the field staff and office staff in the Bank’s interest.

How to apply the Process of DBBL Job Circular 2023

Interested candidates should apply online. You can apply through https://app.dutchbanglabank.com/Online_Job/.

Application Closing Date: Dutch-Bangla Bank Limited Junior Channel Officer online application is ongoing. Those who are applying before 31st May 2023. After this date, any application is not be accepted.

Note Before: Before applying must carefully read the circular the apply.

Dutch-Bangla Bank Limited DBBL Job Circular 2023

Selection Procedure: Dutch-Bangla Bank Limited Junior Channel Officer’s selection procedure will be three ways –

- Shortlisted candidates to be called for Exam.

- Preliminary and Written Test.

- Viva-voice.

DBBL Admit Card And Exam Result

For the Junior Channel Officer position admit card will be available before the examination on Dutch-Bangla Bank Limited’s official website. Candidates can download the admit card by using the user id and password. Examination routine, seat plan, and result will be published on their official website.

About Dutch-Bangla Bank Limited

Dutch-Bangla Bank Limited (DBBL) has emerged as a trailblazer in the banking sector of Bangladesh, revolutionizing the way financial services are delivered in the country. Established in 1995 as a joint venture between local and Dutch investors, DBBL has consistently embraced technological advancements to provide innovative and convenient banking solutions to its customers. This article explores the unique features and achievements of Dutch-Bangla Bank Limited, highlighting its contributions to the growth of digital banking in Bangladesh.

Pioneering Digital Banking:

DBBL holds the distinction of being the first bank in Bangladesh to introduce automated teller machines (ATMs) and debit cards, laying the foundation for the digitization of financial transactions in the country. The bank’s strategic vision was to make banking services accessible to all, regardless of geographic location or socioeconomic status. This vision led to the launch of various groundbreaking initiatives, such as Internet Banking, Mobile Banking, and Agent Banking, which have redefined banking practices in Bangladesh.

Internet Banking:

DBBL introduced Internet Banking in 2002, allowing customers to perform a wide range of banking activities from the convenience of their homes or offices. With Internet Banking, customers can check account balances, transfer funds, pay bills, and conduct other financial transactions securely through DBBL’s online platform. This service has empowered individuals and businesses, enabling them to manage their finances efficiently without visiting a physical branch.

Mobile Banking:

Recognizing the rapid proliferation of mobile phones in Bangladesh, DBBL introduced Mobile Banking in 2011. This service, branded as “Rocket,” enables customers to access banking services using their mobile phones. Through Rocket, customers can perform transactions such as fund transfers, mobile top-ups, utility bill payments, and merchant payments. The simplicity and accessibility of Rocket have played a crucial role in driving financial inclusion in rural areas, where access to traditional banking services is limited.

Agent Banking:

DBBL’s Agent Banking initiative has further expanded the reach of financial services in Bangladesh. Under this model, authorized agents, typically located in rural or underserved areas, act as intermediaries between the bank and customers. These agents provide basic banking services, including cash deposits, cash withdrawals, and account opening, bringing banking services closer to the unbanked population. The Agent Banking network has significantly contributed to poverty reduction, economic empowerment, and financial literacy in remote regions.

Technological Innovations:

DBBL has continuously embraced technological innovations to enhance customer experience and streamline banking operations. The bank was the first in Bangladesh to introduce biometric ATMs, enabling secure and convenient transactions using fingerprint authentication. Additionally, DBBL pioneered the use of Near Field Communication (NFC) technology in the country, allowing customers to make contactless payments using their debit cards or mobile phones.

Social Responsibility:

Dutch-Bangla Bank Limited has demonstrated a strong commitment to social responsibility. The bank has initiated numerous philanthropic activities, including funding scholarships for underprivileged students, supporting healthcare projects, and contributing to disaster relief efforts. Notably, the bank’s Mobile Medical Services (MMS) provide free healthcare services to people in remote areas, reaching those who lack access to proper medical facilities.

Conclusion:

Dutch-Bangla Bank Limited has played a pivotal role in transforming the banking landscape of Bangladesh through its pioneering digital initiatives. By leveraging technology, the bank has extended financial services to previously underserved segments of society, fostering financial inclusion and economic empowerment. As DBBL continues to innovate and adapt to the evolving needs of its customers, it remains at the forefront of digital banking, inspiring other financial institutions in Bangladesh and beyond to embrace technology-driven solutions for a better banking experience.

#Dutch_Bangla_Bank_Ltd #ডাচ_বাংলা_ব্যাংক_লিমিটেড

Adm,it card for the post of Assistant Engineer

Thanks for your comments. Please clarify your comments.