By the source of NAIC (National Association of Insurance Commissioners) in 2020 of the United States of America per year, the average cost of home insurance is $1,211. In this region (#HomeInsurance) home insurance rates influence based on several factors. The several factors are-

- Where you live.

- How many years living in the state.

- Home’s age.

- Value of the land.

- Marital Status.

- Claims history.

- The size of the home.

- Materials used to build the home.

- And the credit score of the annual premium.

Average Home Insurance Cost by the State of USA

| No | State | Average 6-month Premium | Average Annual Premium |

|---|---|---|---|

| 1 | Louisiana | $1,023 | $1,968 |

| 2 | Florida | $1,015 | $1,951 |

| 3 | Texas | $986 | $1,893 |

| 4 | Oklahoma | $982 | $1,885 |

| 5 | Kansas | $831 | $1,584 |

| 6 | Rhode Island | $815 | $1,551 |

| 7 | Mississippi | $808 | $1,537 |

| 8 | Colorado | $787 | $1,495 |

| 9 | Massachusetts | $783 | $1,488 |

| 10 | Nebraska | $780 | $1,481 |

| 11 | Connecticut | $779 | $1,479 |

| 12 | Alabama | $756 | $1,433 |

| 13 | Arkansas | $736 | $1,373 |

| 14 | Minnesota | $713 | $1,348 |

| 15 | New York | $694 | $1,309 |

| 16 | Missouri | $682 | $1,285 |

| 17 | South Carolina | $674 | $1,269 |

| 18 | Georgia | $673 | $1,267 |

| 19 | North Dakota | $666 | $1,253 |

| 20 | D.C. | $657 | $1,235 |

| 21 | South Dakota | $640 | $1,202 |

| 22 | Tennessee | $637 | $1,196 |

| 23 | New Jersey | $635 | $1,192 |

| 24 | Montana | $626 | $1,174 |

| 25 | Wyoming | $617 | $1,156 |

| 26 | Kentucky | $594 | $1,109 |

| 27 | Hawaii | $590 | $1,102 |

| 28 | North Carolina | $567 | $1,086 |

| 29 | Illinois | $558 | $1,056 |

| 30 | Maryland | $548 | $1,037 |

| 31 | New Mexico | $548 | $1,017 |

| 32 | California | $543 | $1008 |

| 33 | Indiana | $539 | $1000 |

| 34 | Virginia | $539 | $999 |

| 35 | New Hampshire | $525 | $972 |

| 36 | Iowa | $521 | $964 |

| 37 | Alaska | $519 | $959 |

| 38 | Michigan | $510 | $942 |

| 39 | West Virginia | $509 | $940 |

| 40 | Pennsylvania | $505 | $931 |

| 41 | Vermont | $498 | $918 |

| 42 | Maine | $480 | $882 |

| 43 | Ohio | $470 | $862 |

| 44 | Washington | $466 | $854 |

| 45 | Delaware | $456 | $833 |

| 46 | Arizona | $452 | $825 |

| 47 | Wisconsin | $429 | $779 |

| 48 | Nevada | $417 | $755 |

| 49 | Idaho | $404 | $730 |

| 50 | Utah | $385 | $692 |

| 51 | Oregon | $378 | $677 |

| USA Average | $645 | $1,211 |

Most expensive states of Home Insurance

- Louisiana: $1,968

- Florida: $1,951

- Texas: $1,893

- Oklahoma: $1,885

- Kansas: $1,584

Types of home insurance coverage of USA

There are many types of home insurance coverage in the United States of America. Here we mentioned that are some of the most common home insurance coverages:-

- Dwelling coverage.

- Personal property coverage.

- Personal liability coverage.

- Medical payments coverage.

- Additional living expenses.

- Sewer backup coverage.

- Flood coverage.

- Hurricane coverage.

- Earthquake coverage.

- Pet coverage.

- Replacement cost coverage.

- Scheduled personal property coverage.

- Home business coverage.

- Electronics coverage.

- Identity theft protection Coverage.

Home Insurance Discounts of USA

Many times we saw that Homeowners want to discount their home insurance. The discounts will depend on a few factors. The factors are some other ways to save money on home insurance in the USA. There are Bundle your insurance policies, Make your home safer, Renovate your home, Keep up with maintenance, Avoid claims, Be a loyal customer, Insure a new home and pay your premium in full, etc.

How to save money on homeowner’s insurance of USA

There are some ways to reduce your homeowner’s insurance premiums and improve the safety of your home. There are Smoke detectors, Deadbolt locks, Fire extinguishers, Storm shutters, Security systems, Sprinkler system, and New or reinforced roof, etc.

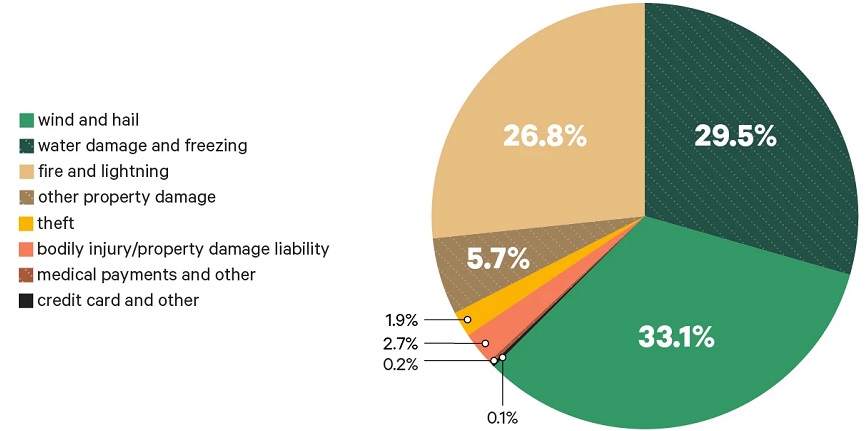

Homeowner Claims by type & percentage of total Insurance losses of USA

Frequently asked questions – Home Insurance of USA

Is home insurance of the USA required by law?

Answer: No.

How can I invoice my home insurance cost of the USA?

Answer: You can get easily estimate your home insurance cost of different states of the United States of America. By considered factors are- Where you live, How many years living in the state, Home’s age, Value of the land, Marital Status, The size of the home, materials used to build the home, and credit score of the annual premium.

More: Average Cost of Homeowners Insurance (2020)

#HomeInsurance #Insurance #InsuranceAgent #InsuranceBroker #insuranceclaim #insuranceagency #InsuranceClaims #insurancecompany #InsurancePolicy #insurancenews #insurancequotes #Insurancereview #InsuranceUSA #insurancecoverage #insurancecompanies #insurancemarket #InsuranceAdvisor